Finance Categories

Recording the cash flow by items will help you get a detailed financial report, due to which you will be able to analyze the structure of income and expenses and understand their effectiveness.

Flowlu allows you to keep track of cash flows at 2 levels: in the context of the three activities of the organization—operating, investing and financial as well as using items of income and expenses.

Operating Activities

Operating activities include all income and expenses related to the main activity of the company.

Examples of financial categories:

- income from the sales of goods (services);

- salaries;

- payments to suppliers;

- office rent;

- taxes;

- office expenses.

Investing Activities

These activities include purchase or sale of own assets for long–term use.

Examples of financial categories:

- own cash investments in the business;

- sale/purchase/repair of tangible assets long–term assets (equipment, transport, office furniture)

- sale/purchase of intangible assets

Financial Activities

These activities include any funds received from a bank or partners, enterprises and their return with interest. In other words, money that was not earned by the company itself.

Examples of financial categories:

- obtaining loans from banks;

- investments, borrowed funds from partners or other enterprises;

- returns on interest;

- cash payments on borrowed funds or loan.

For each type of activity, arbitrary items of income and expenses are set up. With the evolvement of business, new items are added and their level of detail increases.

Grouping the company's cash flow into three types of activities significantly simplifies the analysis and allows you to see the real picture of the company financial situation.

How to Set Up Financial Categories

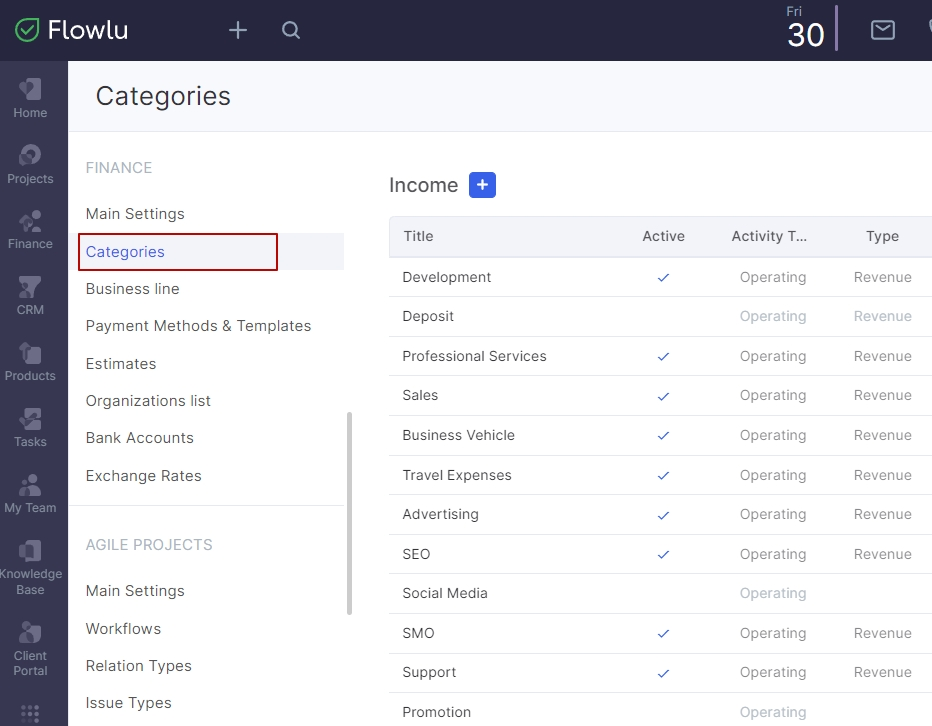

Go to Portal Settings → Finance → Categories.

Here you can add and edit existing categories.

To create a new category, click the "+" button.

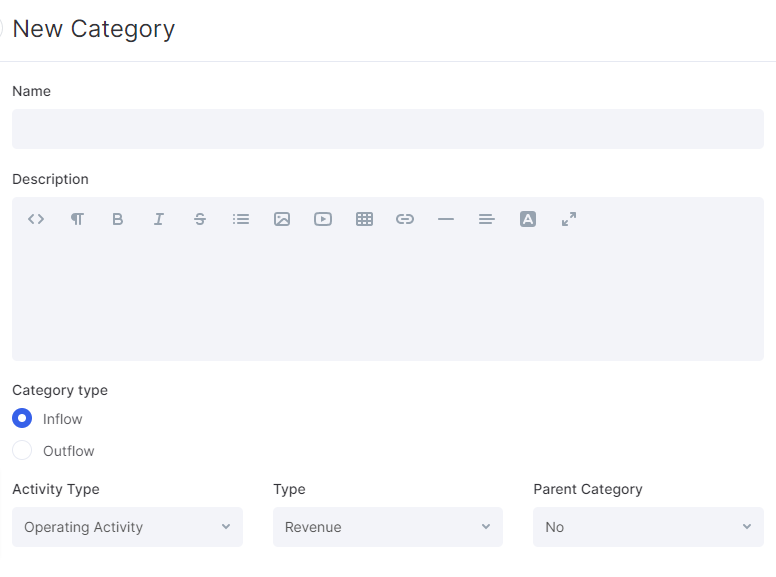

In the opened side panel enter:

- category name;

- category description;

- mark what it is—the inflow or outflow.

- activity type;

- type (revenue, other, etc.);

- parent category.

Save category.

To rename a category, click on its name. Categories that did not have any transactions can be deleted. To do this, click on the red cross sign.

To sort categories use the Drag–and–drop method. Put at the top the frequently used ones.

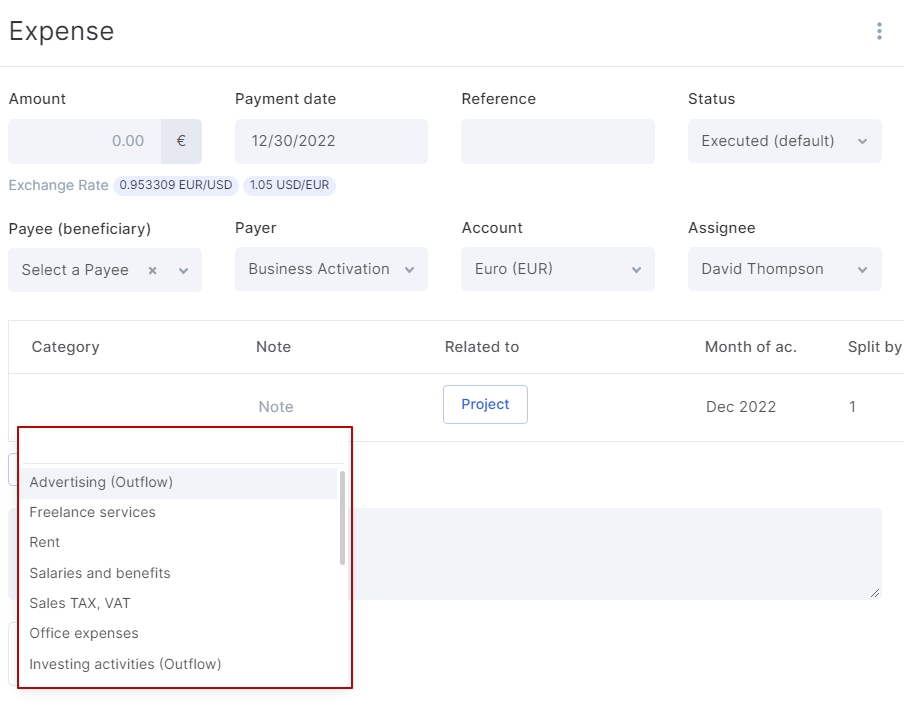

Once you complete setting up the categories, you can start recording the transactions.