Budgeting and Expense Tracking Essentials for Nonprofits

Maybe your organization relies on seasonal fundraisers, a patchwork of small grants, or a few major donors. Or, perhaps your funders have stringent reporting requirements, or you’re managing multiple programs and initiatives that follow different timelines and have very different financial needs.

Whatever your structure, one thing is true across the board: how you plan and track your nonprofit’s spending shapes your ability to deliver impact.

Nonprofit budgeting is all about building a financial framework that reflects your values, supports your strategy, and maintains stakeholders’ trust. Let’s be real – math isn’t most people’s idea of a good time. Budgeting and expense tracking can quickly get overwhelming. Limited capacity, unpredictable revenue, and compliance headaches can make it tough to know where to start or how to improve.

To help, we’ll explore the fundamentals of nonprofit budgeting. You’ll find clear, practical guidance on creating a nonprofit budget that works and tracking expenses – making it easier to keep your finances in line with your mission.

Understanding Nonprofit Budgeting

Before you can build a strong budget, you need to understand the fundamentals, including the unique landscape nonprofits operate in. Let’s start with what makes nonprofit budgeting different from the for-profit world.

What Makes Nonprofit Budgeting Unique

Unlike businesses that focus on profitability, your nonprofit must balance purpose, compliance, and limited resources – all while remaining accountable to donors and the communities you serve.

Your goal is to allocate every dollar to your mission in a sustainable, transparent way. That means investing in your programs, paying staff, and purchasing tools like intuitive fundraising software or nonprofit-friendly platforms like Flowlu for budgeting and project planning.

Here are a few ways nonprofit budgets vary from for-profit organizations:

- Nonprofit budgets are mission-driven: Your budget should prioritize community impact, not bottom-line profits.

- Revenue sources may be diverse and irregular: Unlike businesses with consistent income, nonprofits often depend on grants, donations, and seasonal fundraisers. That can make cash flow unpredictable.

- Funds might be restricted: Some funding comes with strings attached. Restricted funds have to be used for specific purposes (like a grant for a youth program), while unrestricted funds give you more flexibility. Your budget should account for both.

These are just a few examples of how nonprofit budgets vary. Knowing these dynamics will help you create a financial plan that supports your work.

Key Components of a Nonprofit Budget

Your nonprofit’s budget lays out where money will come from and how you'll spend it. Here’s what to include:

1. Revenue Projections: Think about all your expected income—grants you’ve secured, donations you're hopeful about, corporate sponsors, and any revenue your programs generate.

2. Expense Categories: Anticipate costs across key operational areas like:

- Administrative Costs: Operating expenses related to staff compensation, office space, utilities, and so on

- Program Expenses: Direct costs tied to mission-related activities, such as exhibit maintenance for an art museum

- Fundraising Expenses: Upfront expenses for fundraising technology and revenue-generating activities, such as planning events and creating marketing materials

3. Restricted vs. Unrestricted Funds: Separate budget lines to show how restricted income will be used for specific programs, versus unrestricted funds available for general operating support.

4. One-Time or Capital Expenses: If you anticipate large, non-recurring purchases (like major technology upgrades or facility repairs), include those as separate line items.

By including all of these key elements, you’ll empower your team to make smarter decisions, communicate transparently with funders, and adjust proactively when circumstances change. The stronger your budget’s foundation, the more confidently your team members can pursue your mission!

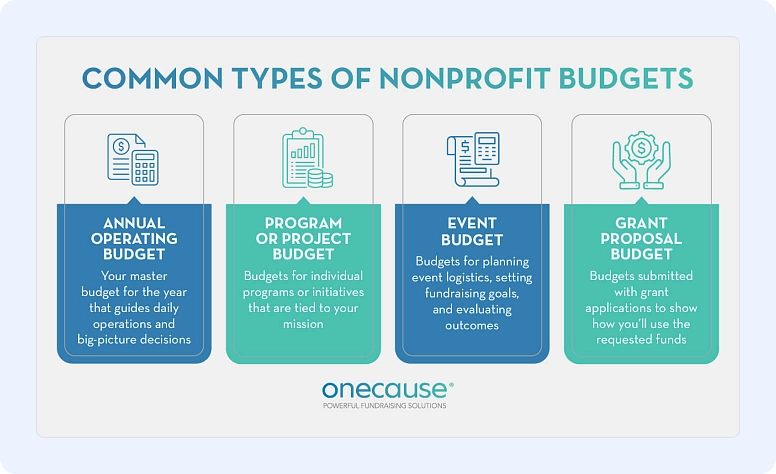

Types of Budgets

Your nonprofit will probably manage more than one type of budget, each with a different purpose. Four common types you might encounter are:

- Annual Operating Budget: This is your organization’s master budget for the fiscal year. It includes all projected revenue across the entire organization, and its purpose is to guide your day-to-day financial management and big-picture decisions.

- Program or Project Budgets: These clarify the cost of running important parts of your mission, including individual programs or initiatives within your organization.

- Event Budgets: These track the specific costs associated with fundraising or awareness events. Event budgets help you plan logistics, set fundraising goals, and measure the return on investment for each event.

- Grant Proposal Budgets: When applying for a grant, you’ll often need a standalone budget that outlines how the requested funds will be used. This demonstrates reliability and sound financial management to potential funders.

Maintaining multiple types of budgets helps your team plan at different levels: organization-wide, program-specific, and funder-facing. When used together, these budgets create a layered financial roadmap that helps your nonprofit prioritize resources and operate ethically.

Tips for Creating Your Nonprofit Budget

Building a nonprofit budget doesn’t have to be complicated! These tips will help you create a plan that keeps your organization focused, flexible, and financially healthy.

Review Historical Data

Look at your organization’s financial activity from the past few years. Try to spot spending trends, seasonal income patterns, and areas where projections didn’t align with actual revenue. Even if your programs or funding sources have changed, historical data gives you a grounded starting point for setting realistic numbers. Tools like Flowlu can centralize past expense reports and revenue records, making this review faster and more accurate.

If you’re a newer nonprofit and are unsure how to structure your first budget, look for free nonprofit budget templates as a guide. Many nonprofits use templates as a starting point and customize them based on prior income and expense patterns. While not a long-term solution, a simple spreadsheet with monthly columns and a few core categories can be a solid starting point.

Involve Key Staff and Board Members

Budgeting shouldn’t be a solo task. In fact, collaborative budgeting improves accuracy and buy-in across multiple departments.

Consider including program staff, finance team members, and board members (especially your treasurer and finance committee). Program staff can provide insight into their expenses, while board members can check that your budget aligns with your long-term goals and big-picture strategies.

Use Conservative Income Estimates

It’s easy to be optimistic when projecting revenue, but overestimating income can lead to shortfalls that hurt your programs and operations. Instead, base your budget on confirmed or highly likely funding, and list potential or pending funds separately. This approach helps you plan more responsibly and reduces the risk of having to cut spending midyear.

Plan for Cash Flow, Not Just Totals

A budget that balances on paper won’t necessarily translate to smooth operations. In other words, revenue and expenses don’t always come in at the same time, and that timing gap can create serious challenges.

To plan ahead, map out when you expect income to arrive and when major expenses will hit throughout the year. This month-by-month cash flow view will help you predict slow periods and decide whether you need to delay costs, build up reserves, or shift funding sources to stay on track.

For example, let’s say your annual fundraising gala (where you typically earn a large chunk of your revenue for the year) happens in May. With this in mind, you might choose to delay equipment purchases until summer. This kind of planning helps prevent cash shortfalls, so you can still meet your obligations.

Revisit Your Budget Throughout The Year

Your budget should evolve as your organization’s needs change. Schedule monthly or quarterly check-ins to adapt to new opportunities or challenges and check that you’re using resources effectively.

For instance, imagine new funding comes in unexpectedly in February. Instead of waiting until summer to purchase that equipment you need, you might be able to go ahead and secure it.

Why Nonprofit Expense Tracking Matters

Creating a budget is just your first step to financial health. Tracking how you actually spend your money is just as important. If you don't track expenses, your budget can fall apart.

Let's look at three reasons to track spending.

1. Meeting IRS Reporting Requirements

If your nonprofit files Form 990 or 990-EZ, you should be able to show how you spend money across programs, administration, and fundraising. The IRS wants to see clear, accurate records, and so do charity watchdogs and your donors.

Tracking expenses regularly means you’ll make tax filing easier and avoid mistakes that could risk your tax-exempt status.

2. Preventing Fraud or Misuse

Nonprofits with small teams and limited oversight are naturally more vulnerable to mistakes. A simple expense tracking system adds an extra layer of protection.

When you regularly review and approve expenses, it’s easier to spot anything unusual. For example, you’ll notice duplicate payments or unauthorized purchases before they become unfixable.

3. Complying With Grant Usage Requirements

Grants often come with specific rules related to spending and reporting. If you don’t keep clear records, you risk losing the grant, or you could even hurt your chances of winning grants in the future.

Tracking expenses carefully means you’ll use your funds the right way and have the documentation you need when it’s time to report back to funders.

Tips for Tracking Expenses

Effective expense tracking is what turns your budget from a plan into a tool for keeping your finances on track. It gives you the information you need to be smart, stay accountable, and avoid last-minute scrambling when it’s time to report.

With the right tools and strategies in place, tracking expenses will become a good habit rather than a pain point in your day! Let’s explore strategies to improve how your nonprofit tracks expenses.

Invest in the Right Technology

Manual spreadsheets may work for small organizations that are just starting off. However, as your nonprofit grows, so does the complexity of your finances. Investing in the right resource management software can save time and reduce headaches.

The right platform can make a big difference. Features worth looking for include:

- Fund accounting capabilities

- Grant and program-specific tracking

- Simple expense approval workflows

- Integrations with your fundraising or donor management tools

- Customizable, shareable reports and dashboards

The right tools will make expense tracking feel less like a chore. When systems are connected and data is easy to access, your team can focus on making informed, mission-driven decisions rather than completing paperwork. For instance, Flowlu offers project tracking, budget planning, and approval workflows that can be easily customized for nonprofit operations

Track and Reconcile Expenses Regularly (Not Just at Year-End)

Waiting until the end of the fiscal year to organize your expenses can lead to confusion, missed details, and unnecessary stress. Tracking your expenses regularly gives you a clearer picture of your financial health throughout the year. Plus, it helps you spot issues before they become major problems.

Create a routine for logging and reviewing expenses weekly or biweekly. Then, review reports and reconcile accounts monthly by comparing your nonprofit's bank statements with your internal records to make sure everything matches. Tax prep, grant reporting, and board updates will be much more manageable this way!

Implement a Reliable Expense Approval Process

Spending may become disorganized or even unnoticed without a clear expense approval process. Outline a system that helps your team stay on the same page about spending. In your policy, set clear guidelines for:

- Who can make purchases on your nonprofit’s behalf

- When pre-approval is required for purchases

- Who can approve purchases

- What receipts or notes should accompany reimbursement or credit card use

Documenting and reinforcing these rules tells your staff exactly what’s expected and minimizes mistakes. Over time, you’ll build a culture of financial discipline across your organization.

Start Improving Your Budgeting and Expense Tracking Processes

Budgeting donations and tracking your spending help build trust and show donors that you handle their gifts responsibly.

Strong financial processes give your team clarity and control, even when revenue fluctuates or unexpected challenges arise. You don’t need perfect numbers to make meaningful progress with your projects. You just need a commitment to staying consistent and collaborative!

Learn as you go and be open to improving your approach over time. The effort you put into budgeting and expense tracking today lays the groundwork for greater stability and impact tomorrow. If you need a straightforward way to manage your nonprofit’s finances, projects, and grants in one place, Flowlu can help keep everything organized.

Yes. Even small or new nonprofits benefit from having a basic budget. It helps you plan ahead, make informed decisions, and show funders that you’re organized and responsible with money.

Restricted funds must be used for a specific purpose set by the donor or grant (like a youth program or equipment purchase). Unrestricted funds can be used wherever your organization needs them most, such as staff salaries or rent.

Because it shows where your money actually goes, and whether it lines up with your plans and promises. It also helps you stay compliant with IRS rules, spot mistakes early, and meet grant requirements.