Preparing for Tax Season: A Guide for Nonprofits

You’ve gone through the process of getting 501(c)(3) status for your nonprofit — congratulations! That’s a huge accomplishment and an incredibly important step to set your nonprofit up for successful financial management. However, it doesn’t mean that your nonprofit never has to deal with the IRS.

To retain your tax-exempt status, you’ll need to file a Form 990 every year. And on top of this being necessary for compliance, it’s also one of the ways your organization can promote transparency with supporters, as these filings are publicly accessible.

It can feel overwhelming to get your nonprofit ready for tax season, especially with all of the other things on your plate, but we’ll walk you through what you need to know to get started here!

What Nonprofits Need to File

Form 990 (which we’ll go into more detail below) is the primary annual document you’ll be required to submit to maintain your nonprofit’s tax status. Depending on the state where your nonprofit is located and if you’ve hired employees or contractors, you may also need to file additional forms, which we’ll discuss later in this section.

Form 990

Form 990 is a little like your nonprofit’s report card, since it lets the government and your supporters know how you’re managing your finances and confirms that you’re still qualified for tax-exempt status.

When you fill out your Form 990, you’ll disclose data such as:

- Activities and Governance: This refers to your mission and significant activities, how many employees you have, how many voting members are on your board, etc.

- Revenue: How much income is coming from contributions and grants? What was your program service revenue this year? Did you earn any investment income or bring in funding from any other sources?

- Expenses: You’ll list your organization’s fundraising, program, and administrative expenses. In addition, you’ll need to disclose the top five salaries at your organization, along with some additional financial information depending on your situation.

It’s a good general rule that if your organization is tax-exempt, you’ll have to file a Form 990. However, there are a few exceptions. Religious houses of worship, government-run organizations, and political organizations don’t fall under the Form 990 umbrella.

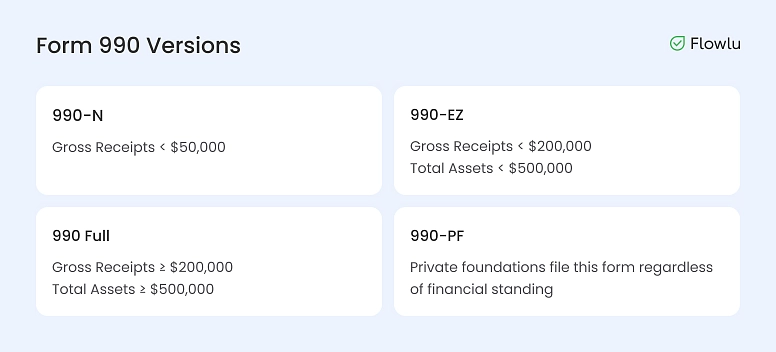

There are four types of Form 990s, and which one your nonprofit files will be based on your gross receipts and total assets.

Check out the chart below to see which version of the Form 990 your nonprofit should fill out:

Form 990-N and Form 990-EZ are shorter versions for small to mid-sized nonprofits. Because private foundations are more financially complicated, the Form 990-PF is a more robust version of the report.

There are penalties for not filing a Form 990 for your nonprofit, like losing your tax-exempt status if you don’t file for three consecutive years, so you must be prepared to complete this!

As mentioned earlier, Form 990s are publicly available for at least three years after you submit them. And the information from this report is often pulled by nonprofit databases like Guidestar. When potential donors research your organization, Form 990s show them how you’ve been managing your finances and maintaining compliance with federal regulations.

It may not be the flashiest development strategy for your nonprofit, but it is a tried-and-true way to show your organization is trustworthy and deserves their support.

State-Specific Nonprofit Tax Forms

Form 990 covers a lot of ground, and many states accept a copy of your Form 990 as compliance with their nonprofit regulations, but there are a few exceptions. Some states (like California and New York) require additional information and filings. Check with your state’s department of revenue or a tax professional to ensure you’re following your state-specific requirements.

Employee and Contractor Forms

You’ve probably received a W-2 Form from past employers, and now the tables have turned. For any employees you’ve hired, your nonprofit will need to issue them a Form W-2 by January 31 every year so they can correctly file their individual tax return.

If you’ve hired any contractors over the past tax year, they’ll receive a form as well. Maybe that’s a freelance fundraiser who helped you achieve your annual fund goal or a lawyer who worked with you to navigate a complex partnership agreement. You’ll issue any contractor who has been paid over the required threshold of $600 a Form 1099. Like the W-2, this needs to be issued by January 31 regardless of your nonprofit’s fiscal year.

If you’re not sure what forms you need to issue or file, it’s always a good idea to check with a tax professional to confirm your nonprofit is complying with both state and federal financial regulations.

What Nonprofits Need to Do for Donors

While you’re prepping forms to submit for your nonprofit, you also need to issue annual receipts to your donors no later than the following January 31, so they can report any donations on their tax forms. It’s best practice to provide these receipts throughout the year, especially for one-time donations. But your organization might decide to provide some annually, such as for donors who submit monthly recurring donations.

For a donor to claim a charitable contribution on their tax return, the amount has to be $250 or more and they must have a written acknowledgement. The donation can be monetary or an in-kind donation, and there are different receipt requirements for each one.

Monetary Donations

Monetary donation acknowledgments are generally straightforward. The annual receipt you send to donors must include:

1. Your nonprofit’s name

2. The donation amount

3. A statement about reimbursement for contributions:

- If no goods or services were provided by your nonprofit in exchange for the donation, you’ll write a statement to that effect

- If goods or services were provided in return for the donation, then a description and good faith estimate of those items’ value.

In-Kind Donations

For in-kind donations where your nonprofit has received anything other than a monetary donation (i.e., goods, services, or immaterial assets) to support your mission, the written acknowledgment is slightly different.

You’ll still include your nonprofit’s name and statement as to whether there was an exchange in return for the donation, but instead of the cash value, you’ll provide a description of the in-kind donation. Your nonprofit is not legally allowed to list the value of an in-kind donation on a receipt—instead, leave a space for the donor to fill in an estimate themselves.

For either monetary or in-kind donations, this is a great opportunity for a personalized touchpoint with your supporters. Alongside the receipt, share your gratitude for their generosity and the progress they helped you make with your mission over the past year.

Nonprofit Tax Deadlines

We’ve already thrown out one deadline for your nonprofit to keep in mind, January 31, so your employees, contractors, and donors can all meet their tax deadlines. Now we’ll dive into what your nonprofit’s tax deadline is for the 990.

The short answer is — it depends.

The determining factor is the end of your nonprofit’s fiscal year. If you can’t remember it off the top of your head, you can find that in your bylaws, your 1023, your Form SS-4, or previous years’ Form 990.

Your Form 990 return date is typically five and a half months after the end of your fiscal year. For example, if your nonprofit runs a calendar fiscal year (ending on December 31st), then your deadline is May 15. If your nonprofit’s fiscal year ends on June 30, then your deadline will be November 15. You can find the IRS’s breakdown of deadlines here.

If meeting a high-pressure deadline isn’t possible for your nonprofit, the good news is that you can get an extension for Form 990 by filing Form 8868. Once approved, you can push back your deadline by six months.

With the extension, you’ve got plenty of time to file your Form 990, especially if you want to complete an independent financial audit before you fill it out. But don’t let the year slip away from you—there are financial penalties for filing late, and as we mentioned before, failing to file for three years means you’ll lose your tax-exempt status, and you may incur fees depending on how late the form is filed.

How to Prep for Tax Season All Year Long

Whenever your nonprofit’s filing deadline falls, you can go ahead and do your future self a favor by taking a few steps to smooth out the process when you need to tackle it next.

Here are a few tips that you can implement right now:

1. Keep accurate and easily accessible records

Tax filings are all about reporting what’s going on at your nonprofit. You’ll make it a lot easier on yourself if you set up a sustainable financial management system from the get-go.

Of course, this includes all of the money-related best practices, but it’s also about your organizational practices. Are you tracking donations (cash, check, digital, in-kind, etc) in the same place? Are you recording business expenses in a timely manner? Do your employees know where to submit receipts?

Having a centralized (and protected) source of truth for all of your information will save you many headaches in the long run. This means storing records and completing financial processes like reporting and budgeting in a dedicated accounting platform, not spreadsheets.

Many nonprofits use an operations platform like Flowlu to centralize financial documents, donation records, contracts, and expense tracking in one secure place. By keeping budgets, reports, and supporting documents connected to the same system your team uses every day, you reduce last-minute scrambling when tax season arrives.

2. Automate processes where possible

If you’re already using software tools for donor management, operational functions, and/or your communications, check that you’re taking advantage of all the work they can do for you. Can your CRM system mailmerge and send annual donation receipts? Can your HR vendor handle populating W-2s?

If you find yourself punching in the same information over and over on different forms, there is probably a process you can set up to make this easier for you. Just always make sure that your nonprofit’s data and any donor, employee, or stakeholder data are being protected and used correctly.

3. Know who to ask for help if you need it

Even if it’s not time to file your nonprofit’s return yet, evaluate the factors that will be in play when it is time. Does your deadline (or extension deadline) fall during a particularly busy season for your programs? Such as in the run-up to Giving Tuesday? Will you be distracted by another priority at that time?

Even if you might have the time capacity to tackle it, do you feel confident with recording the financial details based on accounting reports at your organization? Is one of your board members or volunteers an accountant or tax professional? Would they be willing to assist you with filing? Or does it make sense to work with a nonprofit-specific accounting firm?

These are all questions to think over as you’re considering what’s the best fit for your nonprofit in this season.

When tax preparation spans several roles or teams, having clear ownership and visibility can make a big difference. Some nonprofits find it helpful to explore project management software designed for nonprofits to better organize tasks, timelines, and collaboration.

As your nonprofit continues to grow, a great resource to use is the IRS’s page on the life cycle of an exempt organization, which outlines the interactions between the IRS and nonprofits like yours. Staying compliant with IRS regulations by filing your Form 990 and other tax forms annually is just one important step — alongside programs and development — in furthering your nonprofit’s mission.

Preparing for tax season doesn’t start in April. It starts with how you manage your finances and operations all year long. Online tools like Flowlu can help nonprofits centralize financial records, assign responsibilities, and stay on top of deadlines, making annual filings far less stressful.

If a nonprofit misses its Form 990 deadline, it may face financial penalties from the IRS. More importantly, failing to file for three consecutive years results in an automatic loss of tax-exempt status. If you know you won’t be able to file on time, submitting Form 8868 allows you to request a six-month extension and avoid unnecessary risk.

Yes. Even very small nonprofits are generally required to file a version of Form 990 each year. Organizations with lower gross receipts may qualify to file Form 990-N or Form 990-EZ, which are shorter and simpler, but filing is still required to maintain tax-exempt status.

The best way to stay prepared is to keep financial records organized and up to date year-round. This includes tracking donations and expenses consistently, storing important documents in one place, and clearly assigning responsibilities for reporting and compliance. Using centralized systems and setting reminders for key deadlines can significantly reduce stress when tax season arrives.