The Complete Guide to Sending an Invoice That Gets You Paid

You’ve probably already heard the old saying, “Ask and you shall receive.” And when it comes to getting paid, the sooner you ask for your payment, the faster you’ll get it.

The process of submitting an invoice to a customer or sending out invoices to clients is incredibly easy—especially if you make use of tools like Flowlu. But before sending invoices, you need to learn how to submit an invoice or how to send an invoice to a company. It’s key to keep in mind that you don’t just need to create them and send out invoices—you also need to create a message to go along with the invoice. There are different ways to send invoices that you can use as well.

Best Way to Send Invoices: Step-by-Step Guide

If you’ve never sent an invoice before, it might feel a bit intimidating—but it doesn’t have to be. Just follow these simple steps to send a bill with confidence:

Step #1: Payment Terms

Depending on your business, billing your clients may be the same or different for each customer. For example, the client preferences, project duration, or even the work that you deliver may differ from one customer to another—or may be the same.

There are multiple payment terms that you can choose from. You may prefer to bill your customers hourly, charge an upfront payment or retainer, use installments based on milestones, or even installments based on dates.

Step #2: Payment Schedule

Before you send an invoice for payment, you need to know when to actually send it. The truth is, it will depend on your business and the service that you provide. However, in most cases, it’s always best to get an upfront payment first and not start working before you receive it. If this is the option you choose, you should send the invoice as soon as the client agrees to the work you’ll do for them. You may send an invoice to the client either when you sign an online contract or when the client accepts your proposal. As soon as you get paid, you should start working immediately.

If you’re using Flowlu and you’re wondering how to send an invoice, the process couldn’t be any easier. After all, you just need to use a template that you like, include your business details—such as your logo, for example—and send an invoice to the customer.

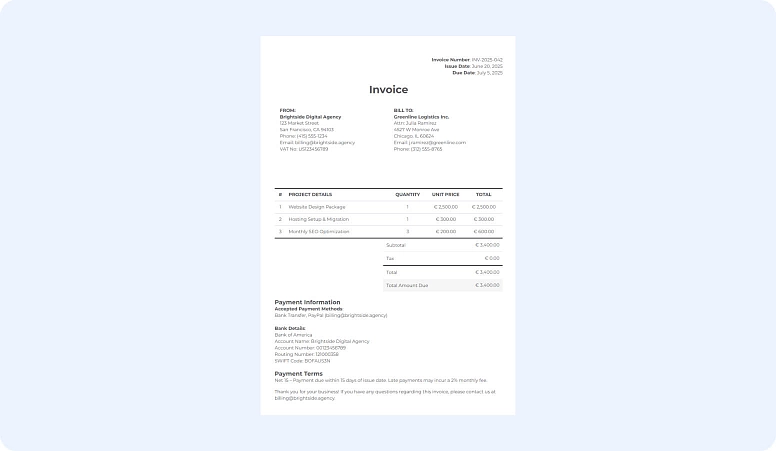

Step #3: Information To Include

Before you send an invoice, make sure your customer has everything they need to pay you on time. Here’s what to include on every invoice:

- Invoice Title & Number: Adding the title “Invoice” and a number is crucial to keep yourself organized. After all, you’ll know exactly which invoice a client is referring to, as well as the payment associated with each invoice you issue.

- Your Contact Information: At the top of all your invoices, you should include your business logo, name, address, phone number, and email. With Flowlu, you can do this once and set it as the template you will always use. It will save you a lot of time.

- Customer’s Contact Information: Just like your information needs to be on all invoices that you send, the customer’s name, address, email, and phone number should also be clearly stated.

- Project Details: Your invoice should always describe the work provided by you. Consider adding line items to list the services or products delivered, along with their prices.

- Amount Details: In this part of the invoice, you need to include taxes, discounts, and finally, the total amount due.

- Due Date: This is very important to include. After all, your customer needs to know the final date for making the payment—and you need to know when to expect your cash.

- Forms of Payment: This is where you have to specify how your client can pay. Also, some places or industries require you to add things like a tax ID, VAT number, or business registration to your invoice. If you’re not sure, it’s best to check or ask your accountant.

Step #4: Template

It’s always best to use a template when you’re sending an invoice to a client—and with Flowlu, it’s very easy. You just create it once as you like (with your information, preferred colors, and a specific layout you like) and keep using it instead of creating one from scratch for every new project.

Besides, you may even use rules to automate the invoice processing. Not only will this save you a lot of time, but you’ll also prevent human errors and mistakes.

Step #5: Send the Invoice

If you’re looking for how to send out invoices, Flowlu can be a great help once again. After all, you have two different options for sending an invoice to a company:

- Email the invoices directly to your clients

- Share a link with your customers

Whichever option you go with, your clients will be able to view the invoice, download it, print a PDF, and—if you’ve enabled online payments—pay it directly.

If you're emailing the invoice, don’t forget to include a short message. The easiest approach is to create a general template you can quickly personalize for each client. There are plenty of examples out there, but here’s one you can use as-is or tweak to fit your tone:

Hi [Client name],

Please click below to access your [Project name] Invoice #[invoice number].

Your current balance is [balance amount], and payment in full is due on [Due date]. Within the invoice, you’ll find both credit and ACH payment options.

Thank you for your time and collaboration! As a reminder, your next invoice will be sent on [Invoice date].

Please let me know if you have any questions regarding your project or payment.

Thanks!

[Your Name/Business Name]

Step #6: Accept Online Payments

The last thing you want is to give your customers excuses for not paying on time. To prevent this, you should allow your customers to use different payment options—but most importantly, they should be able to pay you online. And with Flowlu, you can accept online payments, making it the best way to send an invoice. This helps you get paid faster and makes accounting simpler.

When you use Flowlu, you’ll not only accept online payments, but you’ll also be notified whenever you get paid—and even when an invoice has been opened but not paid yet. As you can imagine, this gives you incredible control over your business.

If you send the same invoice every month (or every other week), stop doing it manually. Flowlu’s recurring invoice feature lets you:

- Set it and forget it—auto-send on a schedule

- Include the same line items each time

- Get notified when they’re viewed or paid

Perfect for freelancers, agencies, or anyone who bills clients regularly. You stay consistent. They stay reminded.

Step #7: Keep Track Of Invoices

With Flowlu, it’s incredibly easy to keep track of all your invoices. You can quickly check the ones that are already paid, those nearing their due date, and those that have already passed it. In the latter case, it’s time to send an additional message—a payment reminder email, as we’ll show you in the next step.

Step #8: Send Payment Reminder Emails

A polite reminder works wonders. But what if your client still hasn’t paid?

Here’s a gentle nudge email template you can send after the due date has passed:

Subject: Friendly Reminder: Invoice #[1234] for [Project Name]

Hi [Client Name],

I hope you’re doing well! I just wanted to follow up on Invoice #[1234] for [Project Name], which was due on [Due Date], according to our records.

If you’ve already taken care of it, no action needed—thank you! If not, you can make the payment here: [Insert link].

If you have any questions or need anything from me, feel free to reach out.

Thanks again,

[Your Name]

Tip: Set a second reminder to go out a few days later if payment still hasn’t come through. After that, consider a call or message on another platform.

When Payment Still Doesn’t Come: What Now?

If you’ve followed up a couple of times and still no luck, here’s what you can do:

- Step 1: Send a firm but polite final notice (e.g. “Final Reminder: Payment Overdue”).

- Step 2: Offer a short grace period—“Please settle this within 5 business days.”

- Step 3: Mention next steps (e.g., pausing the project or involving collections—only if necessary).

Keep it professional, not personal. You’re running a business, not chasing friends for drinks money.

Common Invoicing Mistakes to Avoid

Even pros slip up. Keep these in check:

- Forgetting to include a due date – No deadline = no urgency.

- Not specifying payment options – Don’t make clients guess how to pay you.

- Using vague descriptions – “Services rendered” won’t cut it. Be specific.

- Sending invoices without context – Always include a short, clear message.

Small details = faster payments.

Bottom Line

Getting paid shouldn't be a hassle. With Flowlu, you can create, send, and track invoices without the busywork. It’s fast, flexible, and makes you look as professional as you are—while giving your clients an easier way to pay.

Send your next invoice with Flowlu—it's simple, smart, and ready when you are.

No matter if you’re a freelancer, run a business, or manage multiple businesses, the process of sending an invoice is the same. The main difference will likely involve the taxes you need to charge.

There are different ways to send an invoice for payment. You can email the invoice directly or simply share a link where your client can view, download, print, and pay. With Flowlu, both options are available.

Most invoices don’t require a signature, but some customers may want one for their records. If that’s the case, you can simply email the invoice for them to sign—either digitally or by printing and signing manually.

The easiest way is with Flowlu. You can create a customized invoice template with all your details, then use automation rules to fill it out accurately every time—so it looks polished, consistent, and ready to email it to customers in minutes.

When you’ve got a bunch of clients, invoicing gets messy fast. Flowlu makes invoicing easier—you can set up templates, track payments, and handle all your invoicing in one spot. Just click to email an invoice. Want to follow up? Set email reminders. You don’t need to dig through email threads anymore—everything about invoicing is right there. Even if your invoicing needs include different currencies or languages, Flowlu handles that too.

Yes, and it saves a ton of time. Flowlu lets you automate invoicing—just set it once, and invoices get sent out as soon as work’s done. You can also send automatic email reminders for unpaid invoices. No more forgetting. Invoicing runs in the background while you focus on your work. You’ll see when someone opens the invoicing email too, so there’s no guessing.

Invoicing through email can get lost fast. With Flowlu, all your invoicing is tracked and tied to the client—even the email replies. You don’t need to hunt through email threads to see what’s going on. Just send the invoice by email, get a clear view of your invoicing history, and keep everything in one place. Invoicing doesn’t need to be a mess.