Avoid Cash Gaps With the Payment Calendar in Flowlu

Free your mind of keeping all upcoming financial operations in it with the Payment Calendar in Flowlu.

The same as you do it with meetings, events and appointments, you can plan your revenues and expenses with the calendar. For such needs, we crafted the Payment Calendar. This feature will help you to carefully store and organize upcoming financial operations inside Flowlu.

What is a Payment Calendar

Payment Calendar is a tool for business owners, finance directors, accountants and for any executives who want to keep track of upcoming or recurring financial operations. Payment Calendar will show you cash gaps up ahead, so you can focus on rebuilding your financial strategy and reconsidering expenses.

Beside the Budgeting, which is mostly long-term management, the payment calendar mostly covers short–term financial management.

How to use the Payment Calendar in Flowlu

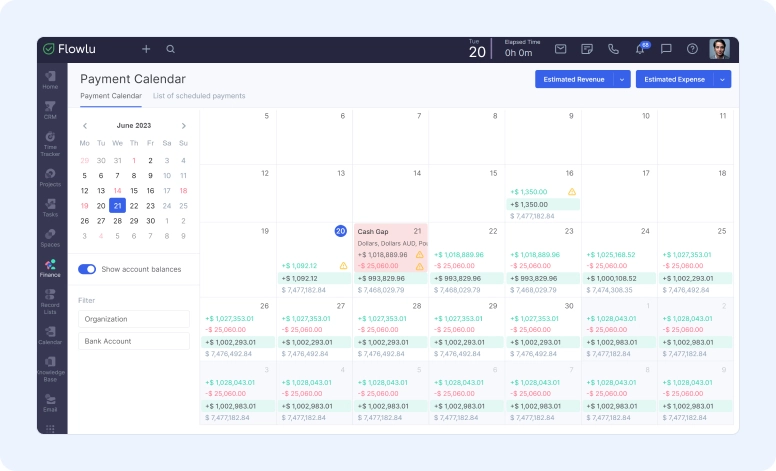

In the Payment Calendar, you can create planned revenues and expenses. On the main tab, you can see all estimated transfers for a month, but when you click on a certain day, you can see all planned transfers related to your bank accounts. Detailed page allows to see actual and estimated inflow and outflow, as well as see if the gash gap is possible on this day.

In Flowlu, the Payment Calendar is connected with other financial tools. When a planned payment is created in the calendar, you can link any cash income or outcome to it and a planned payment will be marked as paid.

You can also track the opening and closing balances per day to get more insights about your financial situation.

Use Case

Let’s assume that you have some regular expenses: rent fees, payments for vendors, administrative charges, salaries, interests on loans, etc. It’s a total mess when you’re trying to keep them all in your mind or excel spreadsheets. And when it comes to tracking regular revenues as well, mistake probability becomes critical. You can plan them up ahead in the payment calendar. Also, you can easily make financial operations recurring, which is extremely important when it comes to regular transactions, such as rent or salaries.

If a cash gap is expected, the calendar will immediately let you know about it: it will show you when and what amounts will not be enough in the accounts. In that case, the calendar will help you to see which expense items are the most resource-consuming and which expenses need to be cutted.

To learn more about our brand-new payment calendar and explore it at its finest, check out our knowledge base.

Payment Calendar is a tool for business owners, finance directors, accountants and for any executives who want to keep track of upcoming or recurring financial operations. Payment Calendar will show you cash gaps up ahead, so you can focus on rebuilding your financial strategy and reconsidering expenses.

There are several benefits to using a payment calendar. It can help you stay organized and ensure that all planned financial transactions, such as rents, salaries, outsourced services, etc., are completed on time.

You can access the payment calendar via a specific piece of software that has such a feature. For example, Flowlu has a payment calendar that is linked to your finances and projects, so you can easily track all planned financial activities for all projects and predict cash gaps in one single app.

If you have any questions about the payment calendar, explore our knowledge base. If you want to take a deep dive into this feature, you can always contact the Flowlu support team.