Best Invoicing Software for Freelancers: Top 7 Tools

Freelancing involves far more than doing the work and chatting with clients. You are also the person juggling all the background business tasks: sending invoices, checking for late payments, keeping track of who owes what.

Some of these jobs may feel manageable, but they have a way of piling up. Before long, you are spending hours chasing payments instead of focusing on the work that actually pays.

That is the moment an invoicing app earns its spot in your daily toolkit. The right tool does more than just send bills. It helps you stay organized, avoids awkward follow-ups, and gives you more time to focus on projects rather than paperwork.

Why Do You Need an Invoicing Tool for Freelancers

Most independent contractors first send the product or complete the service for the client and only then email them the invoice. However, if you’ve been a freelancer for some time, you may have noticed that you have to work with more clients at the same time — sometimes what feels like an unlimited list.

And while this is a great thing, the reality is that it is also a burden on your back when you have to create an invoice for each client and send it.

But you’ll also need to make sure that the invoice is actually paid on time. This is a lot to handle when you’re in the middle of other projects with other clients. This is why you should look for the best invoicing software with payment reminders for freelancers and small business professionals to help you out.

The good news is that the best invoicing software for solo workers isn't very expensive, unlike what you may think. Since freelancers’ invoicing is a lot simpler than large companies’ invoicing processes, these tools are a lot more affordable for independent service providers.

How Does an Invoicing System for Freelancers Work?

No matter if you’re looking for an app for the self-employed or if you’re looking for online billing software for freelancers, the invoicing process is usually the same.

Step #1: Create the Invoice:

The first thing you do in the invoicing process is to actually create a bull using a freelance invoice generator or software tool. If you’re already using an invoice service for self-employed professionals, like Flowlu, it should already include some different templates that you may customize. Nevertheless, your billing documents need to always include some key elements:

- Invoice number

- Contact information (your and your client’s business names, addresses, emails, and phone numbers)

- Price of the services or products

- Payment information (you should be able to accept payments via PayPal, Venmo, or others. In case you’re already using a freelance billing app, the client should immediately see a link to make the payment.)

- Due date.

Step #2: Send the Invoice:

Most solo entrepreneurs usually send bills by email. If you are using some kind of billing tool, it may send them automatically through the app or platform.

Step #3: Follow Up With the Client:

Whenever the client didn’t pay and the due date already passed, you need to follow up with the client. Again, the best billing software for freelancers with automated invoicing features can help here as well, since it will send a follow-up email immediately.

Not sure which features you’ll use? Start with a free estimate maker or invoice generator tool to see what matters (templates, pay links, notes) — no account needed.

6 Features the Best Online Invoicing for Freelancers Needs to Include

As we already mentioned above, invoicing software for freelancers is much simpler and more affordable than invoicing tools for larger businesses or companies. However, they still need to include some features:

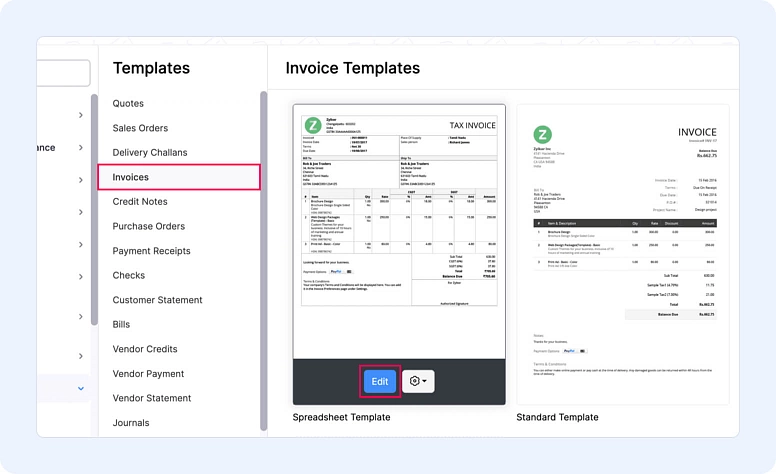

#1: Templates:

If you’re willing to invest in an invoice software tool, then you want to ensure that it saves you time by coming with different templates ready for you to use. The best invoicing system for gig workers will allow you to customize the templates as you want, so you can keep your business documents consistent and professional.

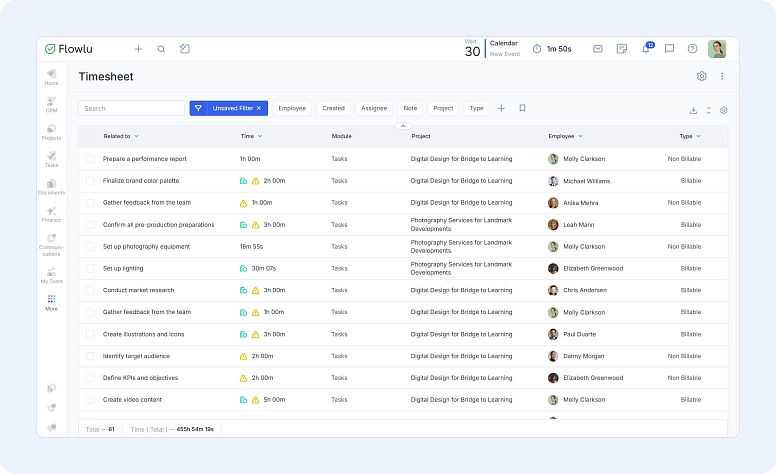

#2: Time Tracking:

For some freelancers who usually work by the hour, having a billing system that helps them keep track of the time (billing hours) dedicated to a specific project is perfect.

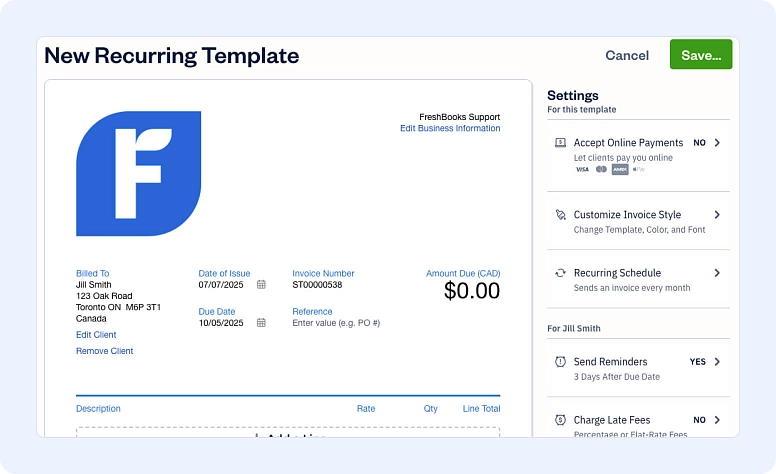

#3: Recurring Invoices:

For many self-employed professionals, it’s normal to work with the same client over and over again. So, why do you need to start from scratch every time you need to send him an invoice for your services or products? Tools like Flowlu let you automate this by setting up recurring billing for repeat clients.

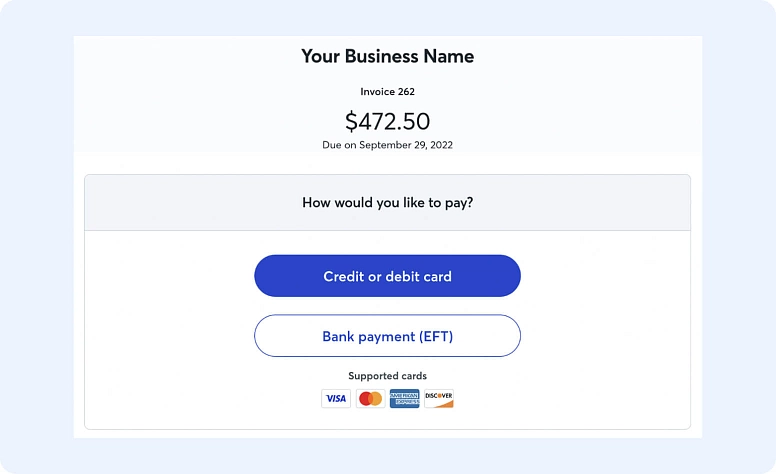

#4: Payment Options:

The best invoicing software for the self-employed needs to accept online payments. The truth is that checks are a thing from the past, and most people prefer to use their debit or credit card instead of making a wire transfer, for example. So, just provide your clients with different online payment options.

Please note that the software you choose should keep track not only of the payments that were done on time by clients but also the payments that passed the due date.

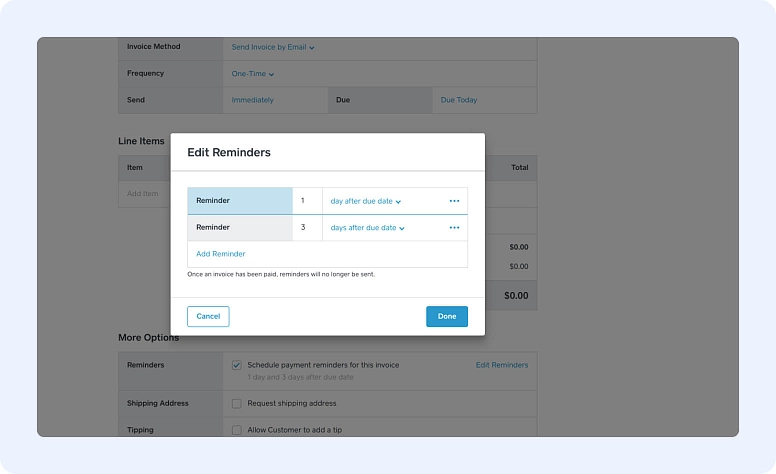

#5: Automatic Payment Reminders:

Along with what we just said, you want to ensure that the software that you pick keeps track of all invoices—the paid and the unpaid ones. And when a payment is about to reach the due date, you can set an automatic payment reminder to be sent to the client.

This way, the client may still pay on time and, in the worst case, he is reminded that he just missed the payment. This means that you don’t need to reach the client immediately on your own, only after this entire process and only in case the client didn’t pay.

#6: Unlimited Invoices & Clients:

If you have never tried invoicing software for solo workers before, you don’t know that most systems have a limited number of bills you can send each month. While for most freelancers it will be difficult to reach these limits, you want to make sure that the tool that you pick allows you to send unlimited billing to as many clients as you need in the future.

How to Choose the Best Invoice App for the Self-Employed

Using the client billing software for self-employed professionals can help you stay focused on your work instead of paperwork, freeing up time for the parts of your business you enjoy most. There are 4 key points you need to think about to help you choose the billing or payment app for independent professionals:

#1: The Features:

Regardless of whether you’re thinking the more features the better, more features will also bring complexity and a bigger price tag. Therefore, you want to determine beforehand the must-have features that you need.

#2: Your Overall Business:

Depending on your business size, you need to choose the right product for you. It’s important to keep in mind that you have both no-cost and paid options, and even some of the paid options offer complimentary trials for a few days.

#3: Number of Clients Supported:

Some invoicing tools for contract workers put a limit on the number of clients they support. While not all tools are the same, it pays to be careful and determine if you won’t need to upgrade to a much more expensive plan in just a couple of months. Ideally, you should choose one that offers unlimited clients.

#4: Cost:

Keep in mind that the cost of using such software is not only how much you pay each month but also the commissions you need to pay for accepting online payments, which can affect your business income.

The 7 Best Invoicing for Freelancers

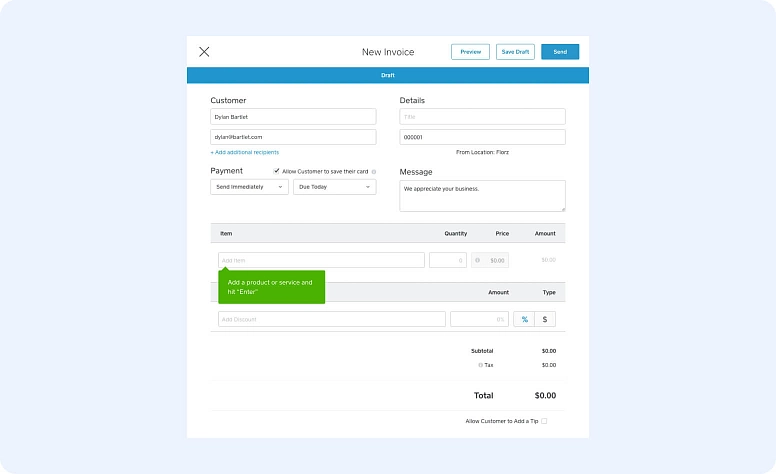

#1: Flowlu:

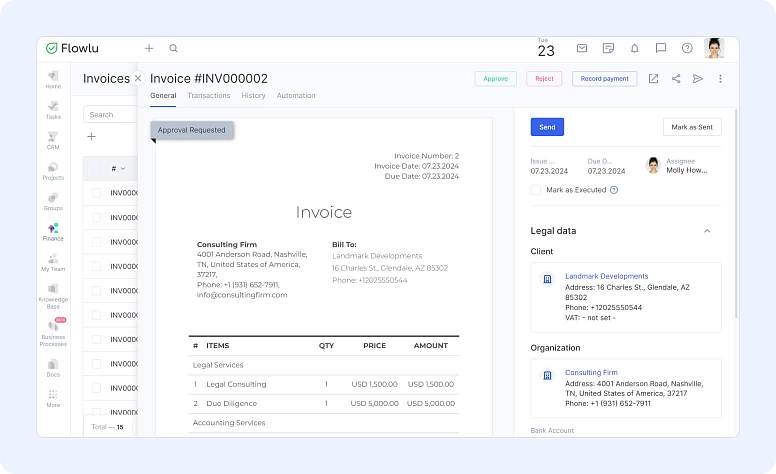

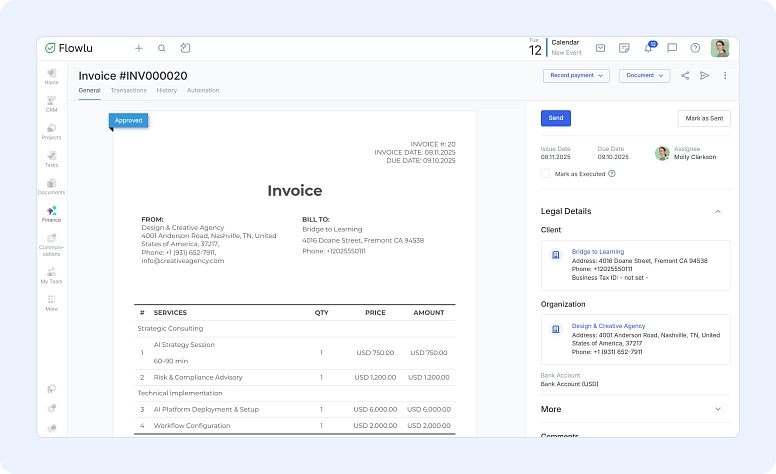

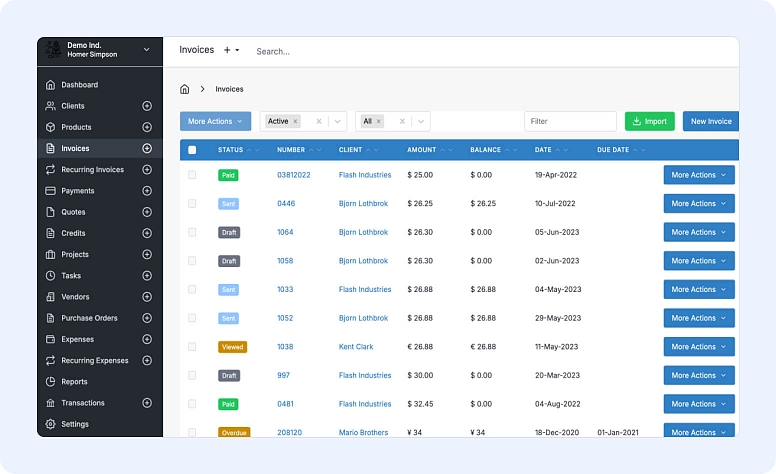

Flowlu is one of the best invoicing tools for freelancers and solo businesses in 2025 due to several reasons. With a simple and intuitive dashboard, you can start managing your invoices immediately without any problems, even if you never tried such a tool before.

One of the things that clients like in Flowlu software is that you can customize one of the many different templates they have, or you can create your own templates. This can be a huge time-saver, especially when you tend to sell similar products or services. You don’t need to keep adding the same thing over and over again to your invoices.

When it’s time to send a bill to your client, you may share a link to it in a chat or send it via email. It’s up to you. No matter what you prefer, your client will be able to view it, download it, print it in PDF, and pay for it.

Flowlu is one of the best options for all solo operators and businesses because this software also allows you to automate the entire invoicing process (with automation rules defined by you), as well as set recurring payment requests.

Since Flowlu allows many different integrations (Stripe, PayPal, etc.), it will be easier to be paid online. Not only will you be notified that you got the payment, but it will also be recorded. And if you work by the hour, Flowlu also keeps track of the time due to its built-in time tracking.

Features:

- Easy-to-use invoice builder

- Customizable templates and the possibility of creating your own

- Get-paid-online option

- Use automation rules to send bills

- Keep track of paid and unpaid invoices

- Time tracking

- Invoicing reports & dashboards

- Integrated CRM with client history of invoicing

- App available for both Android and iOS

Pros & Cons:

Pros:

- Extremely easy to use

- All-in-one solution (none of your client information will ever be lost)

- Full customization

- Automation features

Cons:

- It has many different features, and it’s easy to get lost if you’ve never worked with such software

- No credit notes (but they promise to add this soon!)

Free trial: 14 days

Free plan: Yes, unlimited invoicing (for 100 clients)

Price: From $15 per user

#2: Wave Invoicing:

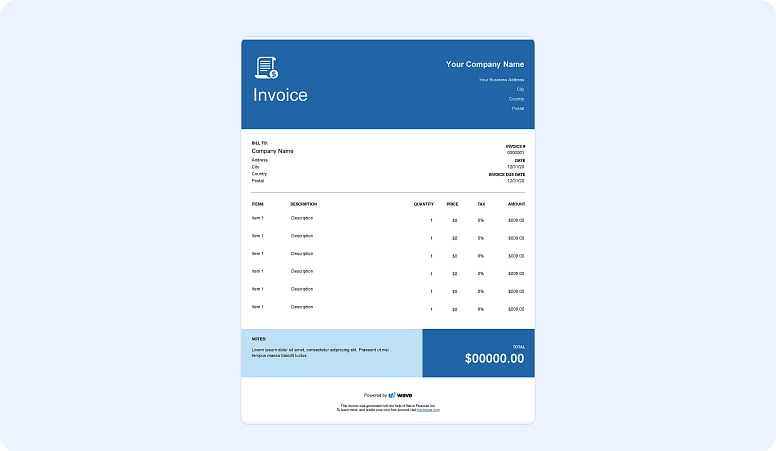

While you may already know Wave Invoicing for its accounting software, this company is revolutionizing the market with one of the best no-cost invoicing for freelancers. If you want both, you’ll be glad to know that they’re both free.

With Wave Invoicing software, it will be easier not only to create customized and personalized payment documents but also to accept online payments using credit and debit cards. You will also be able to take advantage of setting automatic payment reminders to your clients and have the sales tax automatically calculated.

Wave Invoicing is cloud-based but also comes with an app for both iOS and Android systems.

Pros & Cons:

Pros:

- User-friendly invoicing system

- Intuitive design to customize documents

- Accept deposits through estimates

- Message templates

Cons:

- Clients complain about poor customer support

- Users find Wave's business size limitations restrictive (primarily designed for small companies only)

Free trial: 30 days

Free plan: Yes

Price: $170 USD/year, billed annually

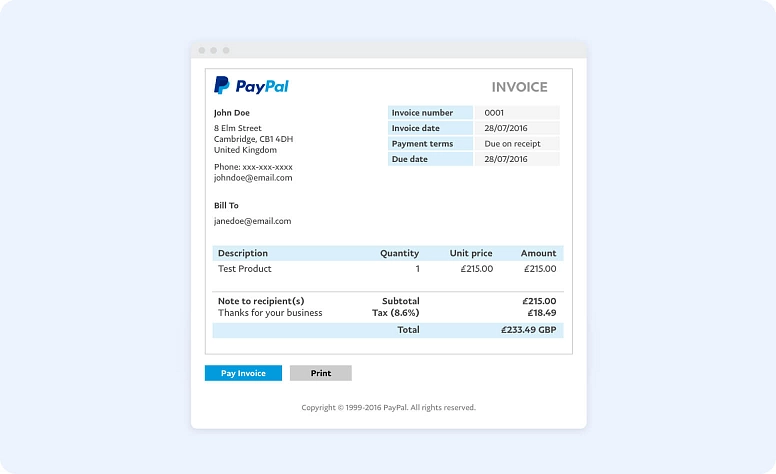

#3: PayPal:

And since we’re already talking about the best zero-cost invoicing apps for independent service providers, it’s impossible to leave PayPal out of this list. The reality is that PayPal is not only secure, it is incredibly easy to use. Besides, you just need to set your account as a business to have zero-price invoicing.

Just like Wave Invoicing, PayPal doesn’t have any limits on the number of bills or clients, giving you unlimited flexibility for sending and receiving payments. Keep in mind that while this may be a great starting point, PayPal doesn’t offer much more than this.

Pros & Cons:

Pros:

- Simple integration and user-friendly design

- Multiple options for payment (credit card, debit cards, PayPal)

- Emails do not go to spam folder

Cons:

- Users find the fees expensive

- Difficult customization

- Clients find customer service very poor

Free trial: Invoicing Plus 1-month trial

Free plan: Yes

Price: Pay only when an invoice is paid (processing fee applies)

#4: Square:

You may already be using Square software for your POS (point of sale). If this is the case and you like the company, you’ll be happy to know that Square also allows you to create your personalized bills, send them, and be paid online, from their mobile phone, or in person. But this tool goes an extra step: it also offers automatic payment reminders, billing and payment tracking, lets you send estimates to clients, and set up recurring invoices.

Square also has its own app available for Android and iPhone users.

Pros & Cons:

Pros:

- Easy setup and clean UI

- Add-ons available (POS, Payroll, Email Marketing, etc.)

- Sends out reminders if the customer didn’t pay on time

Cons:

- High fees

- Reporting of Square is lacking

- Customization options are somewhat limited

Free trial: Square Invoices Plus, which includes a 30-day complimentary trial

Free plan: Yes + processing fees

Price: $29+/mo. + processing fees

#5: FreshBooks:

Nonetheless, you may only be looking for the best billing tool, but FreshBooks’s invoicing app is just a small part of the package you’ll get. After all, FreshBooks is a complete accounting system designed for self-employed professionals and small businesses.

In regards to the invoicing part, you’ll like to know that the software comes with time tracking, as well as it includes retainer invoicing solutions, which can be great if you usually work with the accounting or legal industries.

While we believe FreshBooks is a great solution, it may be a bit complicated for freelancers who are just starting out, as well as it can be a bit expensive. To make things worse, they don’t have a no-cost plan.

Pros & Cons:

Pros:

- Includes estimates, proposals, and retainers

- Track expenses

- Generates tax-time reports

- Expense receipt scanning

- Quick and effective customer support

Cons:

- No customizable dashboards, non-taxable clients

- No fee-free ACH options

- Clients find it expensive with limited client options and increased costs

- Lacks depth in accounting reports

Free trial: 30 days

Free plan: No

Price: From $2.10 USD/month (5 clients)

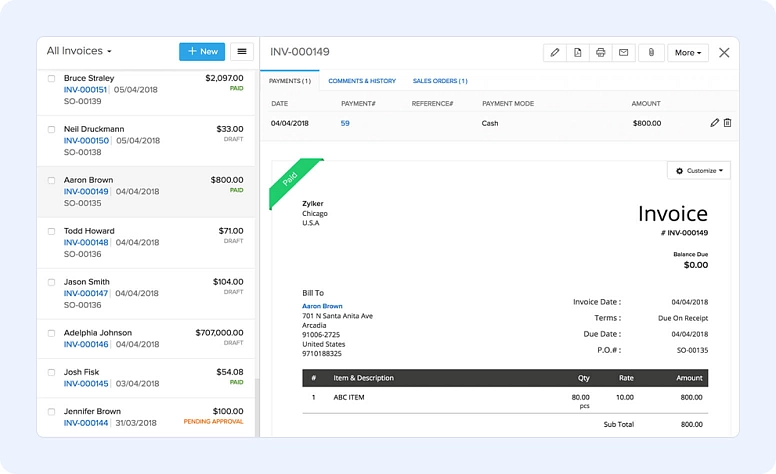

#6: Zoho Invoice:

With Zoho Invoice, you’ll be able not only to create and send bills, but you’ll also have access to many different automated tools. You may even add extra fees for overdue payments, as well as set email alerts that will be sent to clients who have an outstanding invoice.

This simple and effective app also allows you to accept online payments using integrations with some popular companies like Stripe, Square, PayPal, and others.

While you can send unlimited invoices with Zoho Invoice, you have a limit of 5 clients per month.

Pros & Cons:

Pros:

- Accept payments via cards, e-wallets, and ACH

- Provides payment reminders

- Supports recurring invoices

- Easily integrated with other Zoho products (CRM, Books, etc.)

Cons:

- Mobile app can be limiting for more advanced tasks

- You cannot change a client’s currency (without upgrade to another Zoho tool)

- No customer support

Free trial: Forever free

Free plan: Yes

Price: Free

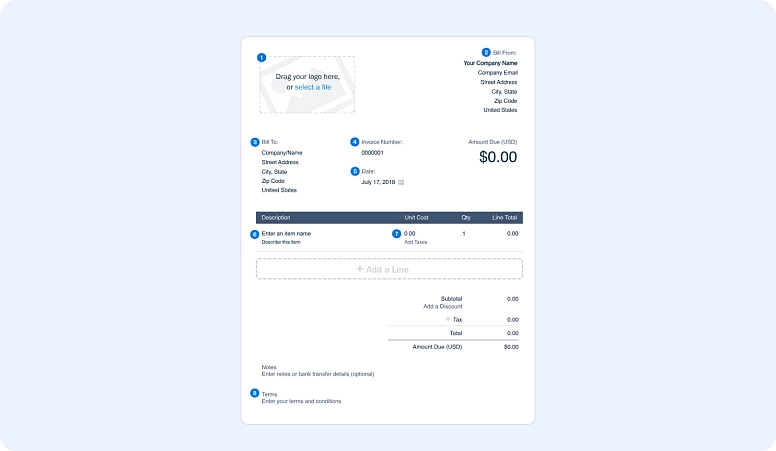

#7: Invoice Ninja:

Invoice Ninja is the last tool for invoicing that we believe is worthwhile mentioning. While it isn’t completely free, when you’re looking for a better tool with some quality capabilities and features, you can still get it at no charge and send unlimited bills to a maximum of 100 clients.

One of the things we like about Invoice Ninja is that it allows many integrations. In fact, it comes with more than 40 payment gateways to process payments.

Pros & Cons:

Pros:

- Professional billing templates

- Bulk email bills, quotes, credits

- Auto sales tax calculation (US)

Cons:

- Users complain about frustrating software bugs and UI inconsistencies

- The new version 5 is unstable and sometimes breaks with upgrades

- The layout may look a bit clunky/outdated

- Some users say that customer support is brief in their answers and unwilling to help

Free trial: No

Free plan: Yes (for 5 clients)

Price: From $12 per month

Quick Comparison Table

|

Tool |

Time Tracking |

Recurring Invoices and Auto Reminders |

Payment Integrations |

Client and Invoice Limits |

Best For |

|

Flowlu |

Yes (built-in and unlimited) |

Yes (with automation rules) |

Stripe, PayPal, Square, and more |

Unlimited invoicing, 100 clients on complimentary plan |

All-in-one platform combining invoicing, CRM, projects, and time tracking |

|

Wave |

No |

Yes |

Credit/debit cards, bank payments |

Unlimited clients and invoices |

Solo entrepreneurs needing basic invoicing and accounting at no cost |

|

Invoice Ninja |

Yes |

Yes |

Cost-free |

Cost-free |

Freelancers who want deep customization or use open-source tools |

|

Square |

No |

Yes |

Square ecosystem (POS, cards, mobile wallets) |

Unlimited clients and invoices |

Contract workers using Square for in-person and mobile sales |

|

FreshBooks |

Yes |

Yes |

Stripe, ACH, credit/debit cards, PayPal |

Unlimited (on paid plans) |

Service-based freelancers needing full accounting + billing features |

|

Zoho Invoice |

Yes |

Yes |

Stripe, PayPal, Square, and others |

Unlimited invoices and clients |

Solo operators using other Zoho products or needing full free functionality |

|

PayPal Invoicing |

No |

No (limited) |

PayPal, credit/debit cards |

Unlimited clients and invoices |

Simple invoicing with quick setup and secure online payments |

Bottom Line

No matter if you just have one client or if you already have some regular clients, it’s important to manage your business right and without wasting a lot of time on administrative tasks. This is why you should opt for using the best professional invoicing software for freelancers like Flowlu. It helps you stay organized, get paid faster, and spend more time doing the work you actually enjoy.

All the business tools that we mentioned that are free, are completely free. Besides, even others that aren’t completely zero-price may offer a complementary trial, for example. Nonetheless, it’s important to keep in mind that you’ll need to pay the fees for accepting online payments, even if the invoicing tool is free. Some of the tools listed above, like Flowlu, Wave and Zoho Invoice, are considered among the best no-charge invoice apps for freelancers in 2025.

Some of the best tools that we mentioned above allow you to send unlimited invoices from your phone, since they have their own apps.

To make sure your client has everything they need to pay you (and pay you on time), your invoice should include a few key things:

- Your and your client’s contact info: names, addresses, phone numbers, and emails

- Invoice number and date: helps keep things organized for both sides

- Description of the work: list the services or products, how many hours, your rate, or the price per item

- Total amount due: don’t forget to include any taxes, discounts, or fees

- Payment terms: due date, how they can pay you (PayPal, Stripe, bank transfer), and any late fees

- Notes section: you can use this for reminders like “Please include the invoice number when sending payment” or “Late payments may be subject to a 5% fee”

Even if you use business invoicing software, it’s still your job to make sure this info is accurate and clear. It’ll help you get paid faster and look more professional.

Free tools usually offer basic invoicing and payment options, but they may limit the number of clients or lack advanced features like automation or time tracking. Paid tools like Flowlu often give you more flexibility, customization, and unlimited client management options, plus integrations and reminders that save time.